Find out when to file IRS Form 2290 and how to prepare necessary documentation

Find out when to file IRS Form 2290 and how to prepare necessary documentation

Blog Article

Got a small trades business you wish to promote? In today's busy marketplace there are two broad ways to get your message out. Yes, you'll still probably need traditional offline marketing-word of mouth is probably the best form of advertising you can get. But the odds are good that you'll need to add online marketing to your media mix. And no, you don't have to be a techie to get your business up and running on the Internet.

SA Ron: Laughs as he says he is able to carry a whole bunch of computers now. Obviously he now has a desk job. But when he travels for work by car 2290 tax form he takes his kettlebells with him. It saves him the time of trying to find a gym when he gets to his destination and he gets a great workout.

Even if you file federal income tax return Form 2290 online late, you can still benefit. The IRS knows that people who file late often have a good reason (a lost job, a health problem, a financial crisis), and that they tend to be owed money. So if you're worried about how much you'll have to pay the IRS, file a federal income tax return and see if they should be paying you instead.

So, what would be your response, apart from thinking "what an absurd contract"? Well, part of you wants to win because that's the competitive nature of the sport, and the main reason you're involved. However, because of the financial penalties for winning, you'll always be mindful of the fact that if you're too successful, then you'll only receive a small percentage of your earnings - after the success tax has been deducted.

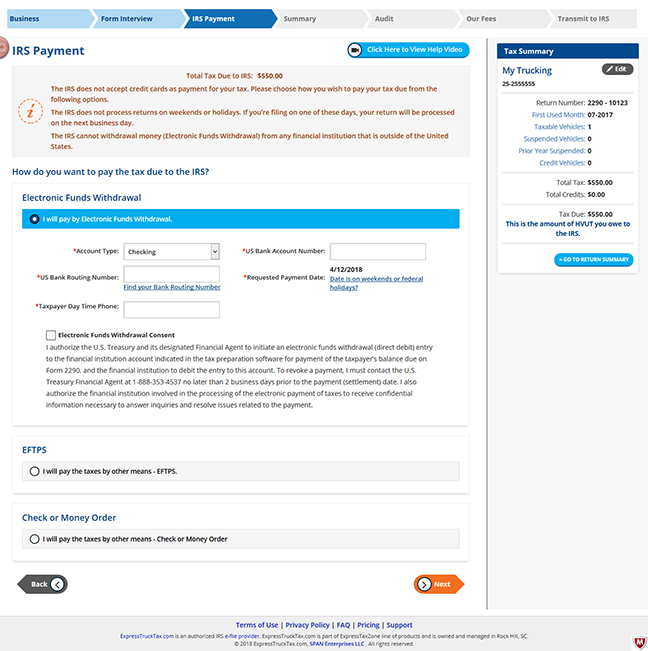

Being self-employed, you also need to pay "estimated taxes". Earnings from self-employment that are not subject to withholding tax will be charged an "estimated tax" in which you have to pay the IRS heavy vehicle tax quarterly and if you fail to to do so, you will be subjected to penalties at the end of the tax year because of underpayment.

Next, advertise the web link or web form in ezines, newsletters, Form 2290 online or high-traffic web sites (as banner ads, exit pops, etc.). When the readers read your ad and click through to your link they will become subscribed to your list.

If you want to hire a company to help you with Heavy Highway Vehicle Use Tax but you still have reservations, consult a financial expert. This individual can give you a clearer picture on how a firm can help solve your dilemma. Report this page